How to Pay for Community College

Financial aid is money given by federal, state, school, and private sources to help make college affordable. This includes grants, work-study, loans, and scholarships. When we think about financial aid, we usually think about the Free Application for Federal Student Aid (FAFSA) and the federal Pell grant. While a big part of financial aid for community college students, Pell grants are only half the story.

Financial Aid Options

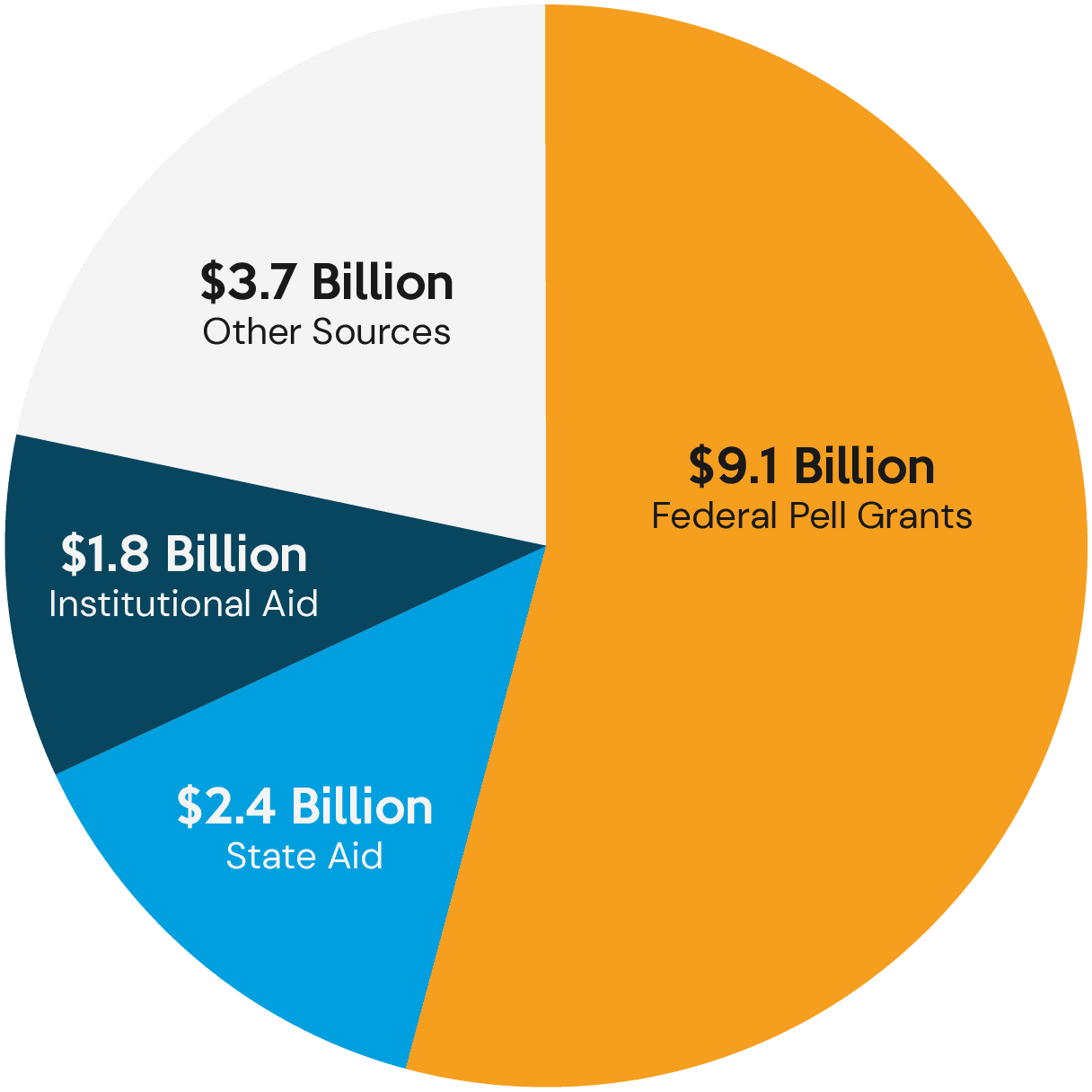

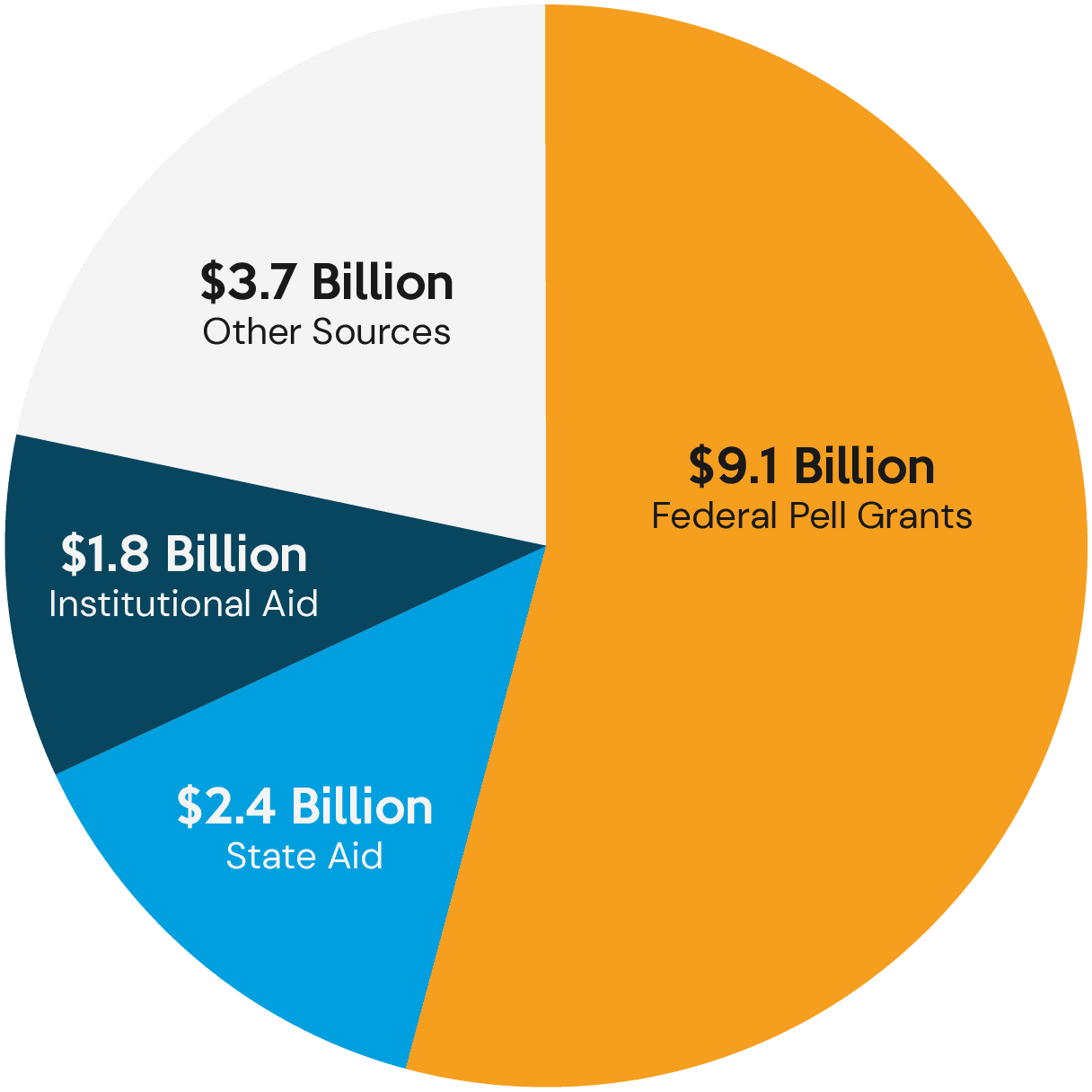

There are different sources of financial aid out there. We're focusing on the ones you don't have to pay back, but generally, colleges combine these sources so you pay the least amount possible. Millions of Americans attending the nation’s public community and technical colleges received a total of $17 billion in financial aid last year. Yes, $17,000,000,000. Here's the breakdown:

![]() Pell Grant: For those who qualify, the maximum Pell grant is $7,395—that covers 100% of community college tuition and fees at nearly every college. The average amount students receive is $4,200. Pell grants are also available for part-time students.

Pell Grant: For those who qualify, the maximum Pell grant is $7,395—that covers 100% of community college tuition and fees at nearly every college. The average amount students receive is $4,200. Pell grants are also available for part-time students.

![]() State Aid: All states have their own financial aid programs. Some are based on need, and some merit. They help fill the gaps when Pell doesn’t.

State Aid: All states have their own financial aid programs. Some are based on need, and some merit. They help fill the gaps when Pell doesn’t.

![]() Institutional Aid: Community colleges come to the rescue by fundraising locally to help students. They also give merit- and performance-based scholarships (for students participating in sports, band, etc.) for a campus life experience.

Institutional Aid: Community colleges come to the rescue by fundraising locally to help students. They also give merit- and performance-based scholarships (for students participating in sports, band, etc.) for a campus life experience.

![]() Organizational Scholarships: Organizations such as Phi Theta Kappa Honor Society offer students the opportunity to apply for organizational scholarships to help fund their community college education and offer transfer scholarships to four-year colleges and universities.

Organizational Scholarships: Organizations such as Phi Theta Kappa Honor Society offer students the opportunity to apply for organizational scholarships to help fund their community college education and offer transfer scholarships to four-year colleges and universities.

![]() Other Sources: Scholarships are everywhere. Your college can help you find scholarships given by local businesses, organizations, private sources, and more. Just ask!

Other Sources: Scholarships are everywhere. Your college can help you find scholarships given by local businesses, organizations, private sources, and more. Just ask!

![]() Student Loans: These are available through federal or private lenders. Student loans are there but should be used as a last resort. Only 18% of community college students rely on loans to help pay for college.

Student Loans: These are available through federal or private lenders. Student loans are there but should be used as a last resort. Only 18% of community college students rely on loans to help pay for college.

You Applied for a Community College Near You, Now What?

Figuring out how to pay for college can be a stressful task, but we’re here to help! The cost of community college is a fraction of what you’re likely to pay at a four-year institution – and with many scholarship opportunities as well as federal aid, community college is a clear choice for the budget-conscious student.

The first step is filling out the FAFSA. Before you begin, check out the Federal Student Aid Office's Federal Student Aid Estimator, a tool to help provide an estimate of how much federal student aid you might be eligible to receive. Just remember, the results will not be 100% accurate until you actually file your FAFSA. The FAFSA form is easier than ever to fill out, either online at fafsa.gov or through the myStudentAid app available on the App Store (iOS) or Google Play (Android). The FAFSA form clearly walks you through every step, and if you have any questions, your chosen college’s financial aid department can often be a huge help!

I Applied for FAFSA, What's Next?

The next step is checking your state’s financial aid programs – many states have programs that cover the remaining tuition gap after federal aid.

If there is still a gap after these options, check with your college. Some colleges have their own financial aid programs, and merit/competitive scholarships you can apply for.

If the price tag still feels daunting, there are other options available as well. Going part-time and taking only one or two classes at a time can let you complete your degree at your own pace, without spending so much money all at once. This is a great option for students focusing on work outside of school or for whom other responsibilities take precedence, who still want to pursue their degree.